aurora co sales tax rate

The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

2020 rates included for use while preparing your income tax deduction.

. Annually if taxable sales are 4800 or less per year if the tax is less than. Aurora Colorado 80012 3037397800 ARAPAHOE COUNTY. The latest sales tax rates for cities in Colorado CO state.

The current total local sales tax rate in Aurora OH is 7000. The current total local sales tax rate in Aurora SD is 5500. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe.

The December 2020 total local sales tax rate was also 0000. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a. The current total local sales tax rate in Aurora NE is 5500.

An alternative sales tax rate of 675 applies in the tax region Centennial which appertains to zip code 80046. The average cumulative sales tax rate in Aurora Colorado is 804. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a.

The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes. An alternative sales tax rate of 881 applies in the tax region Denver which.

This includes the rates on the state county city and special levels. The current total local sales tax rate in Aurora OR is 0000. The December 2020 total local sales tax rate was 8350.

Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling. Aurora has parts of it located within Adams County. The current total local sales tax rate in Aurora CO is 8000.

Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. Aurora Sales Tax Rates for 2022. Special Event Tax Return.

Combined Marijuana Tax Rate Including Sales Tax Rate. The December 2020 total local sales tax rate was also 5500. The December 2020 total local sales tax rate was also 8000.

The current total local sales tax rate in Aurora MO is 8850. The December 2020 total local sales tax rate was also 5500. Groceries are exempt from the Aurora and Colorado state sales taxes.

Aurora collects a 0. Rates include state county and city taxes. The December 2020 total local sales tax rate was 7250.

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

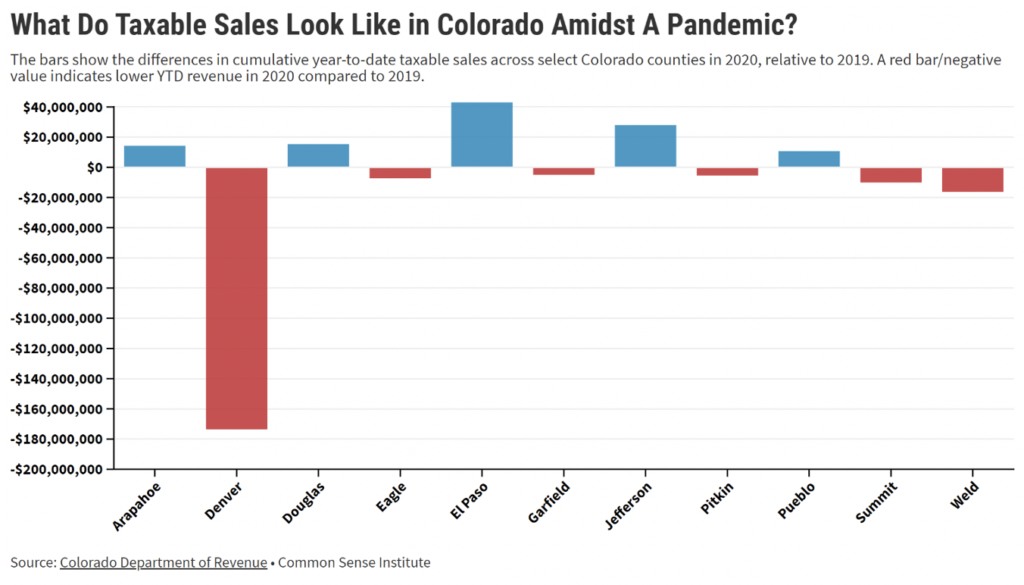

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

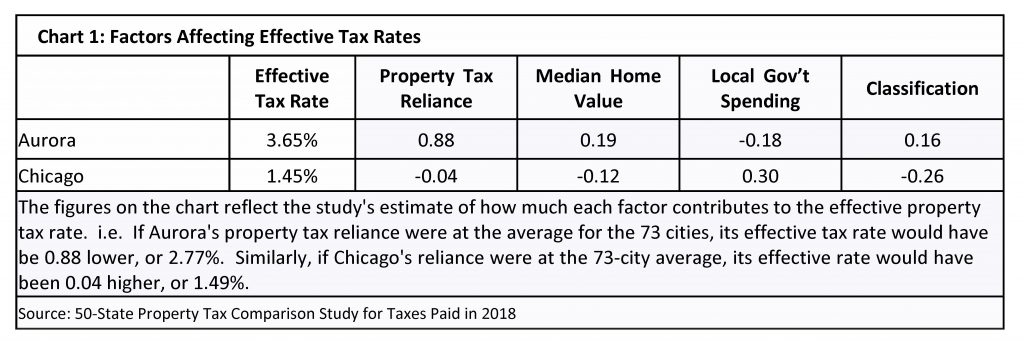

Taxpayers Federation Of Illinois Aurora Tops In Effective Tax Rate Low In Local Government Spending Mike Klemens

The Lawrence County Missouri Local Sales Tax Rate Is A Minimum Of 6 725

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Kansas Sales Tax Rates By City County 2022

U S Property Taxes Comparing Residential And Commercial Rates Across States

How Colorado Taxes Work Auto Dealers Dealr Tax

Aurora Kane County Illinois Sales Tax Rate

Simplify Colorado Tax Simplify Tax

Nebraska Sales Tax Rates By City County 2022

Aurora Colorado Sales Tax Rate Sales Taxes By City September 2022

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Iowa Sales Tax Rates By City County 2022

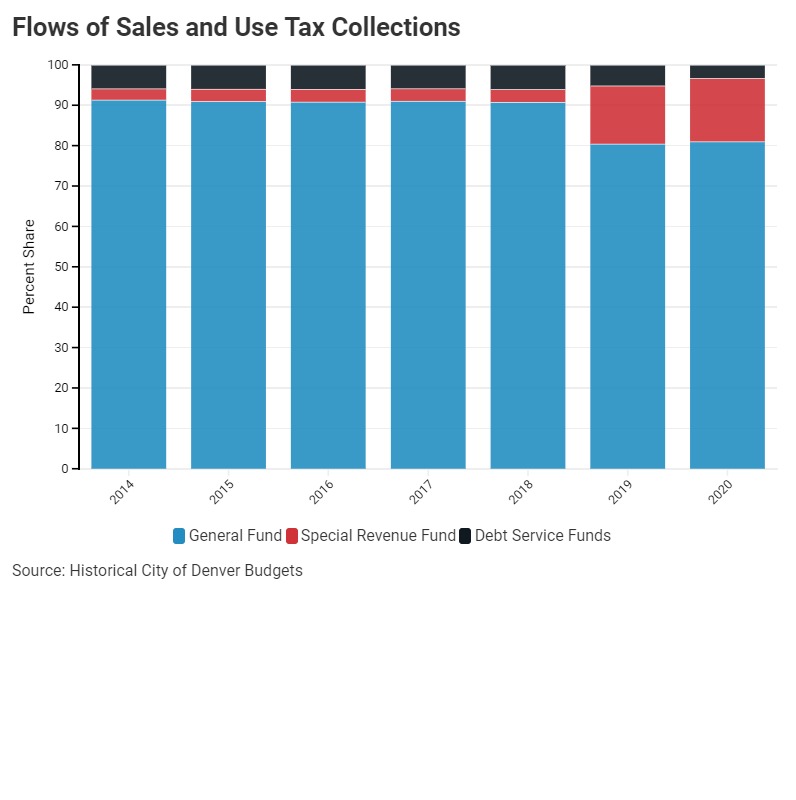

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute